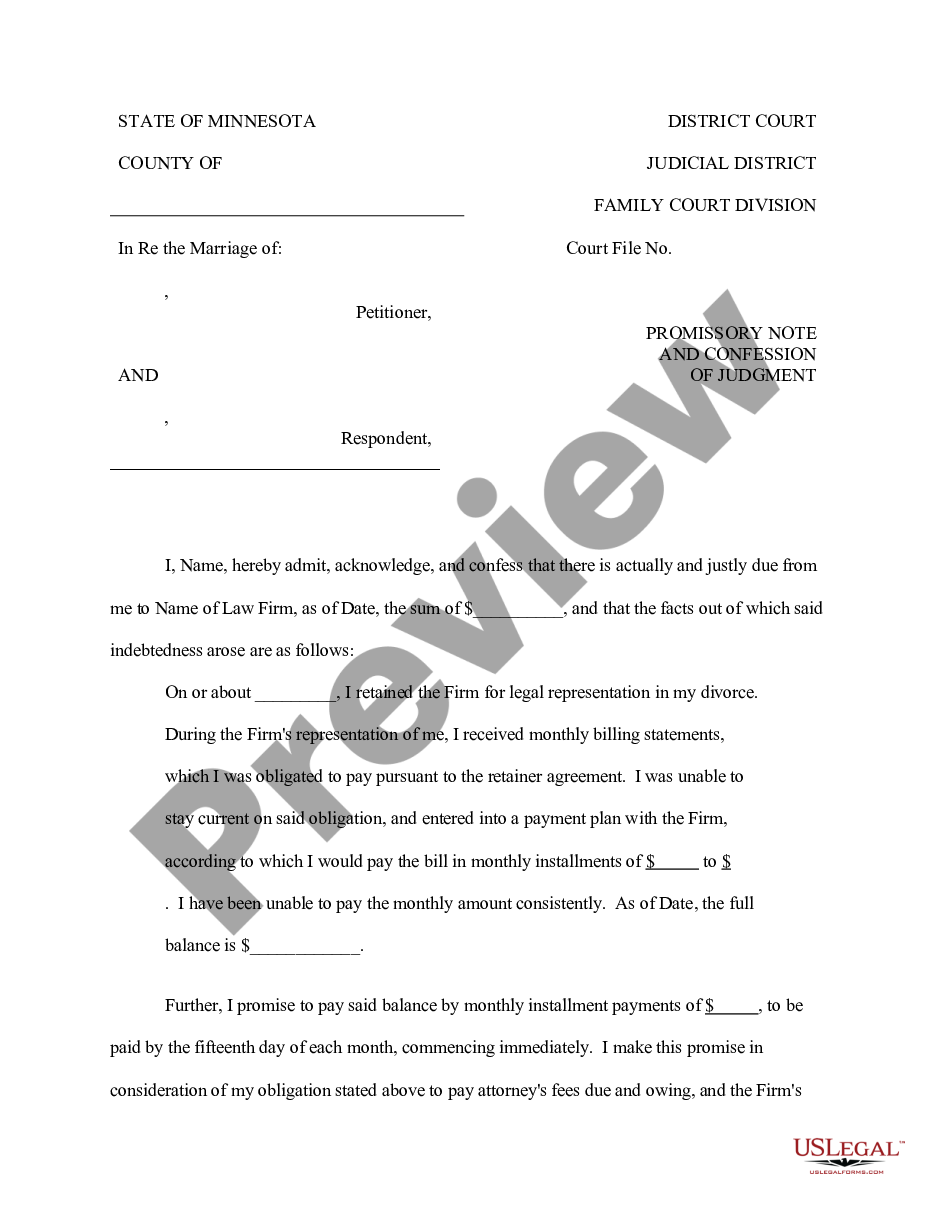

A defendant that signs a confession of judgment has forfeited his right to argue or conflict claims such as liability claims and damages that the other party may place in the future. The only recourse that a borrower at this point is to Petition the Court to Strike or Open the Judgment, and to file a separate emergency Motion to Stay the execution of the Judgment, though it is possible that a Court will not stay execution of a Judgment while a Petition to Strike or Open is pending.Īs one can see, a Confession of Judgment clause in a commercial loan or lease should not be taken lightly, and a prospective borrower or lessee should be aware of the severe consequences if the lender or lessor elects to enforce a Confession of Judgment.Update Table of Contents What is a Confession of Judgment? How is a Confession of Judgment Used? Different Ways a Confession of Judgment May Be Applied What is a Confession of Judgment?Ī confession of judgment is an agreement or a contract in which the defendant in the lawsuit agrees to take on the amount of liability and damages that both parties earlier agreed on. If the loan agreement has a personal guarantee, the lender may confess judgment against the individual and execute against his property in short order. The lender can then begin execution efforts and levy the borrower’s property within 30 days. Once a Judgment is entered by Confession, a delinquent borrower or lessee will receive a notice from the Court notifying the borrower that the Judgment has been entered. In 1996, however, the Pennsylvania Supreme Court restricted the use of Confessions of Judgment to non-consumer debts – and now Confessions of Judgment can only be used in association with commercial transactions in the Commonwealth. The United States Supreme Court, quoting a 1824 New Jersey opinion, noted that Confessions of Judgment are “the loosest way of binding a man’s property that ever was devised in any civilized country.” Many states have altogether invalidated Confessions of Judgment under their respective State Constitutions, and Pennsylvania remains one of the very few jurisdictions that permits them at all. A creature of English common law, the author Charles Dickens noted Confessions of Judgments – then called “cognovits” – with disfavor in his first novel The Pickwick Papers.

Though their use in commercial transactions seems to be growing, Confessions of Judgment in Pennsylvania actually pre-date the formation of the Commonwealth and enjoy a lengthy history, long being criticized for their susceptibility to be employed in predatory ways against the unwary borrower. Proceeding upon a Confession of Judgment is extremely quick compared with the time, cost, and expense associated with normal civil actions.

A Confession of Judgment provision is designed to give the lender a quick, easy, and low cost method to obtain a Judgment against a delinquent borrower or lessee and to preserve the priority of the lender’s lien.

#CONFESSION OF JUDGMENT TRIAL#

A Confession of Judgment differs from normal civil actions to collect a debt in that the borrower essentially waives his due process rights to a trial and permits the lender to proceed directly to a Judgment without giving evidence, holding a Court hearing, allowing the borrower to present a defense or even giving the borrower notice that the lender intends to enter the judgment. This article will give consumers of credit a brief primer on what Confessions of Judgment are, and what rights a borrower is waiving by signing one.Ī Confession of Judgment is a written agreement entered between a lender and a borrower that allows the lender to summarily enter Judgment against the borrower upon the occurrence of a stated event, usually default under the terms of a loan agreement or lease. One requirement that is becoming ubiquitous in lending and leasing in Pennsylvania is a Confession of Judgment clause in loan agreements, often accompanied by personal guarantees. Principals of newer small businesses may be shopping for credit for the first time, or are presented with a first commercial lease. As the economy continues to restrict the availability of credit to small businesses, many borrowers are finding that lenders with which they have had long and mutually beneficial relationships have been restricting lines of credit or adding additional requisites to extend or renew existing lines of credit.

0 kommentar(er)

0 kommentar(er)